https://www.youtube.com/watch?v=ZPSQPm1ezWI

Enhanced Transcribe:

Hey folks Dr Ro here, hope you’re well.

I want to tackle a question that is still coming in. It feels like one of those dreams which seems to be re-occurring and it comes back and back again repeating the experience and this is a conversational piece that I’ve been having for quite a few years now.

I’ve been teaching property for nearly 20 years, and it is a conversation that comes up a lot. Which is how do I choose what strategy to get into?

You may be an accidental landlord. It might be that you’ve got one or two properties already, but you fell into it because you moved out of your own home into another while you and your other half got married and end up buying another house, so you have two other properties which have become your properties for investment.

Or it might be that you just wanted to get real estate and you bought somewhere close to you or you have a broker that said now is a good time. The reality is that you have to approach this in a methodical and detailed way.

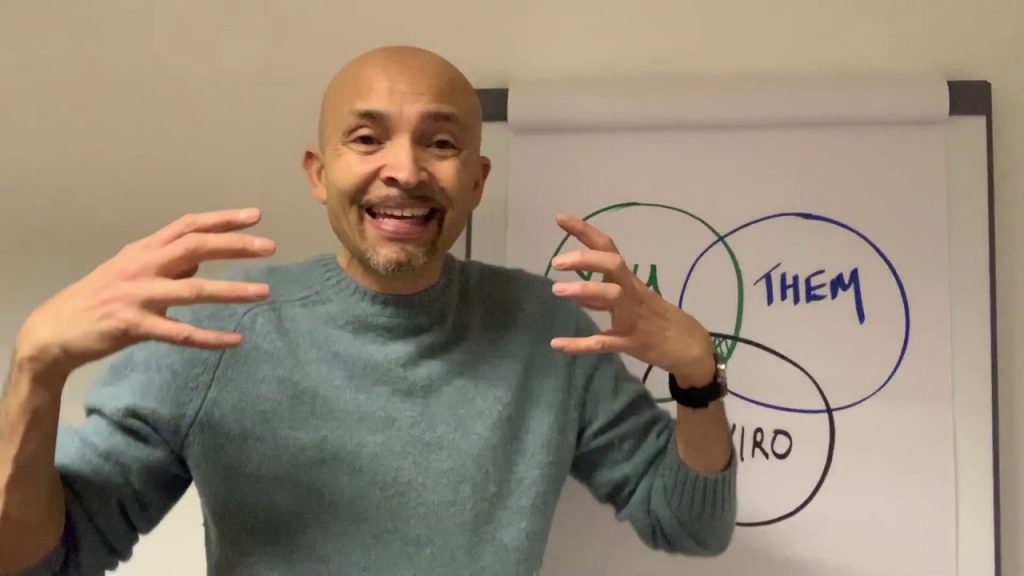

There are four factors I normally say to people that affect the type of strategy you choose: the first one is the result you are looking to achieve.

Are you sitting here now and your 20 years of age, you’ve got loads of money in the bank you’re going to blow it, travel the world and that’s it, you want cash so that will be one type of strategy. Typically a cash strategy to renovate them, selling them and sourcing them brokering deals, whatever that’s going to generate cash for you.

On the other hand, you are 50, 55 and you’ve got kids that are grown and you want to just add them in your pot because you’re actually feeling that your shortfall there, then that might be a slightly longer term strategy.

Yes, you want some cash but you might want to hold assets as well, but equally you might be 30, 40, wanting to get out of your job. You’re pissed off and frustrated and the result for you is basically to get to a situation where I don’t have to work for somebody, I’ve got enough passive income coming in to give me a choice not to have to work. The result is the first major factor that will determine the type of strategies or strategies that you actually adopt when you move forward.

There’s nothing random about this, that is the first thing.

The second thing is the amount of capital that you have to invest if you’re 55, 60, and you want to drive properties home, you want to get two, three, four, five passive income coming in, you might be sitting on a whole bunch of cash because you’ve spend most of you life working. You bring greater equity in your home, you want to release the equity out, get it working for you straight away. You’ve got capital to play with, but you might equally be a 20 year old who has got no capital and you want 50, £100,000 in the bank. The type of strategy you choose will be determined on whether you have or haven’t got capital to start with, and if so there are strategies to help you raise that money. But equally, your goal might be to generate more capital as well, so it’s what’s your result?

What is your outcome? Where do you want to get to in the next two to five years? How much capital do I have to start with and then the life cycle, where are you in your life-cycle? Are you a 20 year old with no kids? Are you a 30 year old thinking about getting married? 40 year old with kids? 50 year old with grown kids or single, or more mature, higher salary higher up the corporate ladder working really hard and knackered and exhausted and wanting to get out?

Are you someone who actually loves what you do, passionate about your career but you realise you haven’t got any security and you’re now 50, 55, 60, 40, 45, 50. You’re like I’m in the cycle where I’m exposed and I need to do something about it. It might be a young couple married to think about kids, but you don’t want a full-time job so you’re in that part of the cycle where what can we do? What if we could be financially dependent and not have to work for somebody else?

I’ve met everybody and everybody under the sun. I’ve had those that want to get property but not to get free just to have some assets. I’ve had others desperate to get out the job. Others critically ill and need to use the portfolio to give them some security so they can have operations and whatever treatments. The last thing is time. How much time have you got? Are you time free or time poor? Are you someone with loads of cash and very little time or somebody with loads of time, but very little cash?

Time is a massive one, at the end of the day it’s the one thing you can’t win back so for a lot of people they’re prepared to put the work in. So don’t underestimate that. And for a lot of people when we talk about time they don’t put as much emphasis on that, as they do money. I personally think if you can win back time, then that gives you a huge amount of opportunity to create more money and that’s a very important conversation to have. The four considerations when deciding on strategy to do number one, what are the results you’re looking to achieve?

Really important.

How much capital money do you have to play with? Where are you in the life-cycle? Are you tired, fed up or excited about your career? Or you’re at the end of the cycle where you’ve had enough, done the career.

And finally, how much time do you have to put into this and we’re not talking about years probably two years of consistent effort with some support and guidance three years, maybe depending on how much time you’ve got available. You’re putting in evenings, weekends and you’re putting in offers and all those things as well. Have a think about that and then start to drill down.

Hopefully that was useful, Dr Ro signing out.

Disclaimer: This video or written publication does not offer investment or financial advice and nothing in them should be construed as investment or financial advice. Our publications provide information and education only. The information contained in our publications is not, and should not be seen as a recommendation to use any particular investment strategy. Always seek financial advice from an independent financial adviser around your own personal financial situation.